What is the SDR deflator?

Details of the calculation follow. For any economy i for year t:

- Let

be the quantity of local currency in the SDR

be the quantity of local currency in the SDR - Let

be the exchange rate between local currency and the SDR

be the exchange rate between local currency and the SDR - Let

be GDP in local currency at current prices

be GDP in local currency at current prices - Let

be GDP in local currency at constant prices relative to a base year a

be GDP in local currency at constant prices relative to a base year a - Let

be the local currency GDP deflator measured relative to a base year a

be the local currency GDP deflator measured relative to a base year a

The weight of each currency in the SDR (expressed in terms of SDRs) is given by

Deflators for each economy in SDR terms are defined by

Which can be rewritten

Where ![]() is the implicit deflator in local currency terms, defined as

is the implicit deflator in local currency terms, defined as ![]() . Thus deflators for each economy in SDR terms are calculated by multiplying by the implicit GDP deflator by the ratio of the exchange rate (local currency to SDR) in year t to the exchange rate in base year a.

. Thus deflators for each economy in SDR terms are calculated by multiplying by the implicit GDP deflator by the ratio of the exchange rate (local currency to SDR) in year t to the exchange rate in base year a.

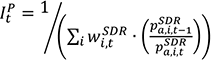

The weights from equation (1) and the deflators from equation (2) are then used to calculate a weighted average of the annual inflation rates derived from the deflators for each economy using a Fisher index (the geometric mean of a Laspeyres and Paasche index):

The SDR deflator (in SDR terms) is constructed from the Fisher index:

![]()

The SDR deflator (in U.S. dollar terms) is then calculated as

![]()

Where the conversion factor from SDR to U.S. dollars is calculated using the Atlas method:

Notes

- The formula used to calculate the SDR deflator in dollar terms does not include a base year exchange rate, which would rescale it relative to the base year value of the SDR. This is because the deflator is only used to calculate the inflation rate (from t-2 to t and from t-1 to t) in the Atlas exchange rate formula and, similarly, is used to update the income thresholds by the annual rate of inflation, therefore the omission of the base year exchange rate (a constant) has no effect.

- The country composition of the euro area GDP deflator has changed over time, the deflator used in the calculation reflects the membership in the euro area at each time period after 1998.

- Prior to 1999, the SDR was comprised of the German mark, French franc, British pound, U.S. dollar, and Japanese yen. From 1999 onward, the euro was included in the SDR and the mark and franc were dropped.

- Prior to 2016, the SDR was comprised of the euro, British pound, U.S. dollar, and Japanese yen. From 2016 onward, the Chinese Yuan was included in the SDR.